I used to receive an awesome email newsletter from Trends.vc that would interview an entrepreneur and ask what they were reading. I haven’t received these emails recently, and I’m missing getting reading recommendations from fellow small business owners.

I’m taking a break from writing about the latest in the world of data and instead offering the 10 best non-fiction books that I’ve read over the past 6 months* in case you, too, are looking for a new book to read.

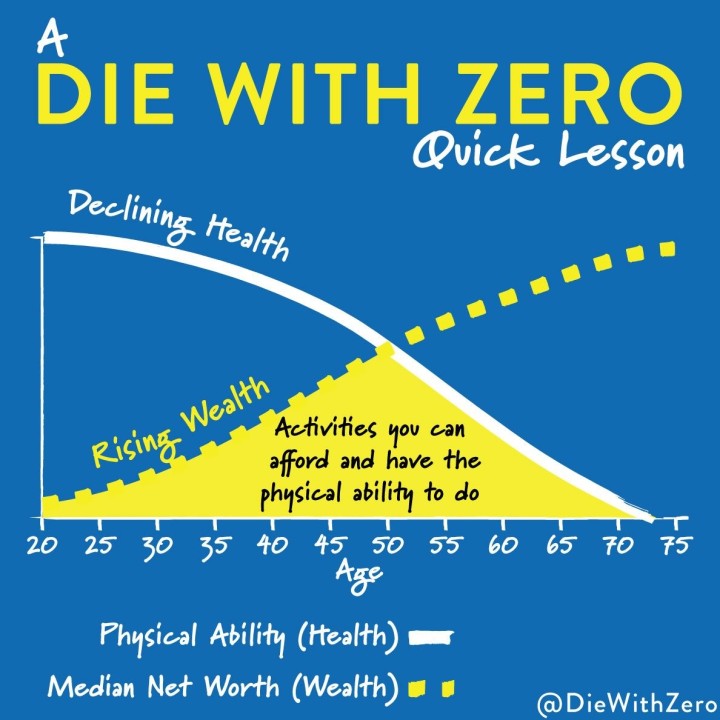

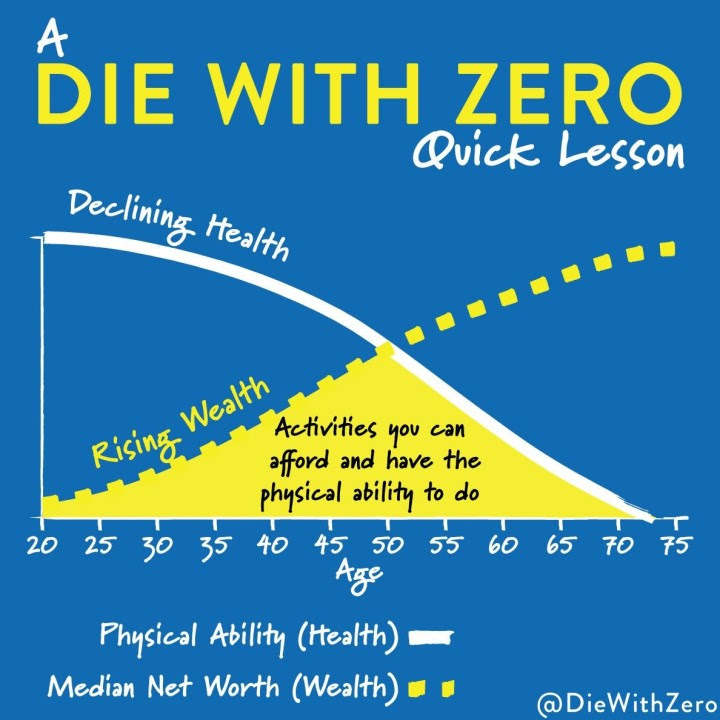

If you only have time to read 1 book, read Die with Zero: Getting All You Can from Your Money and Your Life by Bill Perkins. This book encourages a shift from saving money for retirement to designing a life full of experiences, acknowledging that certain adventures are a better fit for certain ages. It’s a book about how to live a rich life rather than how to be rich.

If Die with Zero doesn’t speak to you, here are 9 more 5-star non-fiction books according to me.

- Hidden Potential: The Science of Achieving Greater Things by Adam Grant – A roadmap for how to configure scaffolding for people and organizations to reach…you guessed it…their hidden potential.

- Unraveling: What I Learned About Life While Shearing Sheep, Dyeing Wool, and Making the World’s Ugliest Sweater by Peggy Orenstein – One of my favorite writers journeys into the world of wool as her daughter leaves for college and the world retreats during the pandemic. I don’t care about wool or knitting, but I’ll read anything Peggy Orenstein writes.

- Going Infinite: The Rise and Fall of a New Tycoon by Michael Lewis – The rise and fall of Sam Bankman-Fried, crypo-king, from the author’s unique perspective embedded within FTX. Lewis is the only author I’d trust to make the shadowy crypto world both understandable and entertaining.

- Exercised: Why Something We Never Evolved to Do Is Healthy and Rewarding by Daniel E. Lieberman – A fun explaination as to why I STILL don’t want to work out even though I feel much better afterwards.

- In Search of Sleep: An Insomniac’s Quest to Understand the Science, Psychology, and Culture of Sleeplessness by Bregje Hofstede, Alice Tetley-Paul (Translator) – The science, psychology, and culture surrounding sleeplessness written by an educated lay-person. Having read many doctor-written books on insomnia, this fellow sufferer was able to offer compassion and understanding, if not a workable solution as I won’t be uprooting my family to rural France.

- Made to Stick: Why Some Ideas Survive and Others Die by Chip Heath, Dan Heath – Offers a formula for how to create messages that are memorable and impactful.

- Crying in H Mart by Michelle Zauner – A memoir of a Korean-American daughter grieving the loss of her mother through their shared love of food. I cried so much through this one, you guys, so much.

- The Happiness Hypothesis: Finding Modern Truth in Ancient Wisdom by Jonathan Haidt – Journey through ancient wisdom and modern psychology to add more happiness to your life today. I normally a fan of pop psychology books, but this one was just the right mix of storytelling and reasonable advice.

- Same as Ever: A Guide to What Never Changes by Morgan House – Who also wrote the blockbuster Psychology of Money. What I like about his new book is that while many of the things that stay the same apply to financial markets, they also are applicable for other important areas of life — like building a business, parenting or staying sane in rapidly changing world.

Got a book recommendation for me? Send me a message and let me know. I’ve still got room on my giant pile of books to read.

* P.S. “Wait? Whaaaaaat? You’ve read more than 10 non-fiction books in 6 months.” Don’t you have…like…two kids…and a business to run…and 4 soccer teams to play on?

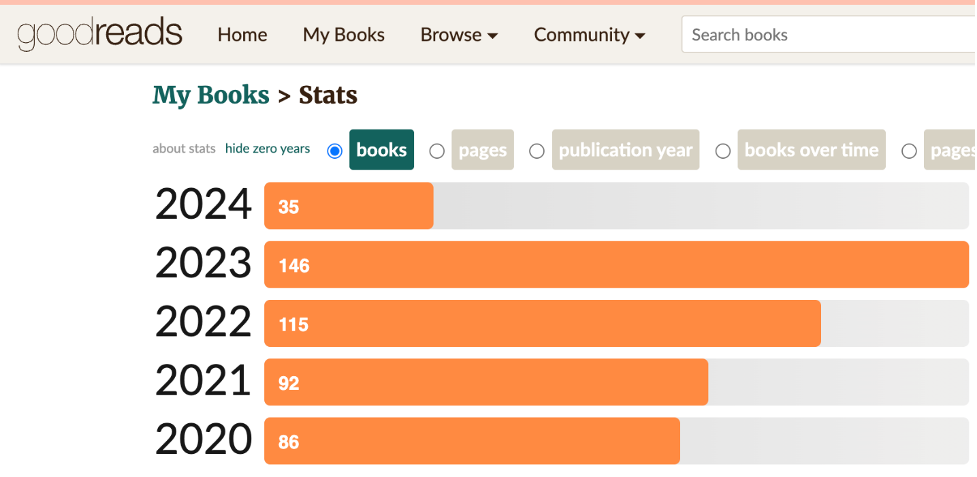

Yes, yes, and yes. Goodreads says I read around 100 books a year, but that includes kids books and books I quit because they didn’t speak to me.

If you caught my nod to insomnia in the description of In Search of Sleep above, I’m sensitive to TV and movies before bed. So after I read with my kids, I read my back-lit Kindle Oasis for until I get sleepy. When I wake up in the middle of the night, I read myself back to sleep. And when I wake up at 4 am, I usually read before starting work.

Non-fiction books work well for this reading as I can get sucked into page turning fiction stories and stay up too late reading…the opposite of what I’m going for. Also like older fiction books like George Elliot’s Middlemarch (which I’m also reading now) work well for this type of reading too.

A couple other reading hints…

- I check out books to read on my Kindle for free from my AMAZING Austin public library.

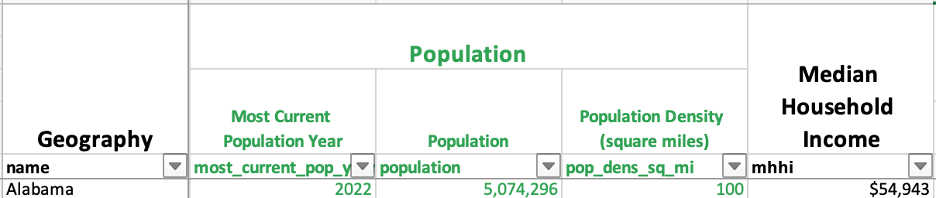

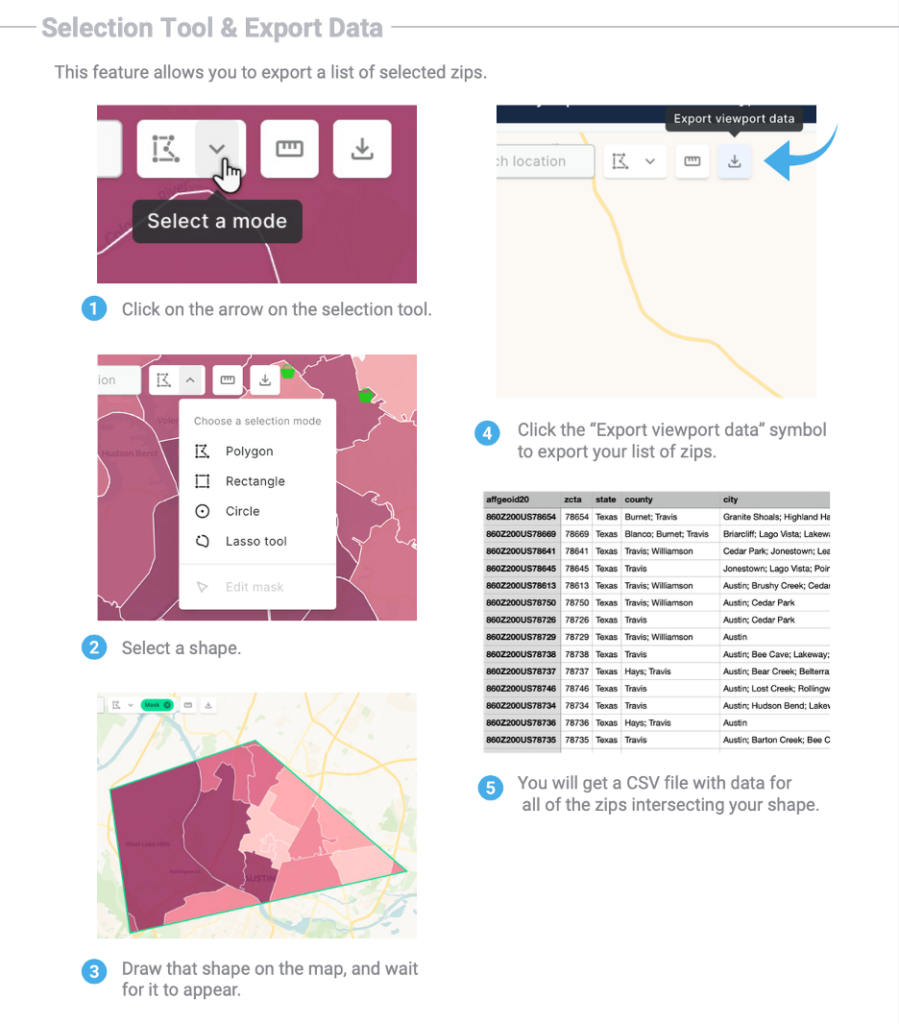

- Goodreads syncs with my Kindle to produce rough tracking like the graph above and a list of what I’m read.

- And Readwise syncs my Kindle highlights (you can highlight passages that speak to you in a Kindle) and emails me 10 highlights a day, helping me remember what I’ve read.