👋 Hi there! I’m Anthony – co-founder of Cubit, and for the past 16 years, the guy behind the curtain building the tools that get your demographic data into those beautiful maps and spreadsheets.

If you’ve been with us from the early days, you might remember me as the “technical genius” (Kristen’s words, I swear!) who coded the first version of Cubit while she made 1,000 cold calls to keep the lights on.

🎉 Big News from the Cubit Team

After 16 years as the face of Cubit, Kristen is off on an exciting new adventure with another company.

While we’re genuinely thrilled for her next chapter, we’ll miss her daily presence and contributions to our team.

💡 What’s Changing?

Not much!

Diana — who many of you already know and love — will continue as your main point of contact. She’s worked closely with Kristen for the past four years and is amazing at keeping things running smoothly.

And as for me?

I’ve been active behind the scenes all along — building our systems, refining our data tools, and helping shape our company vision from day one. Now, I’m stepping into a more visible role. You’ll see me popping up in emails and calls to help solve tricky data challenges and make sure you keep getting the same lightning-fast, above-and-beyond service we’re known for.

✅ What’s Not Changing

- ⚡ Fast, friendly, human help

- 📊 Clean, current demographic data in those user-friendly formats that help you make better business decisions

- 🛠️ Custom solutions when your project’s a little weird (we love weird)

- 🗺️ Maps and reports that make your next step obvious

We’re still the same Cubit – the one that calls you back, adds extra data without being asked, and somehow makes demographics feel easy.

👋 Who You’ll Hear From Now

Kristen will still be helping us behind the scenes for a bit during the transition. But the day-to-day team is now:

- Anthony (that’s me!)

- Diana

- Rochelle

We’re excited to continue working with you in this next chapter of Cubit’s story.

🙋 Want to Say Goodbye or Ask a Question?

To leave a goodbye message for Kristen or ask me a question:

- 👉 Email us at datanerds@cubitplanning.com or fill out the Custom Data Request form .

- 👉 Or leave a message on her LinkedIn announcement

We’d both love to hear from you!

📍 Radius Reports

Get current Census demographics for radius rings around a location — which you can’t do on Census.gov

Get Radius Report📊 Spreadsheet Reports

Identify the right zips, cities, or counties with comprehensive, intuitive spreadsheets of Census demographics.

Browse Reports🛠️ Custom Data Sets

Customized datasets that go beyond basic demographics. Easy to join with your internal data to deliver super-charged insights. Hand off to analysts or developers.

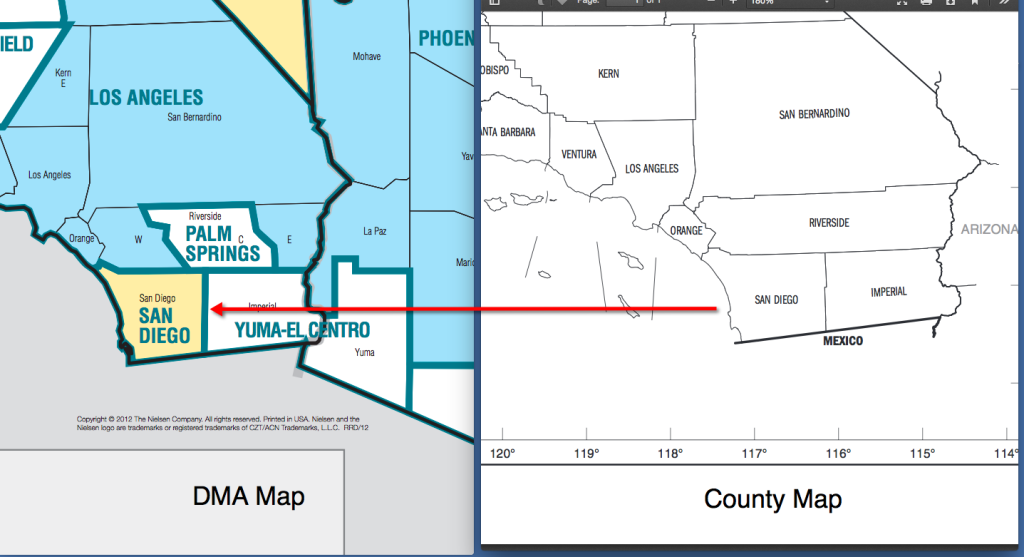

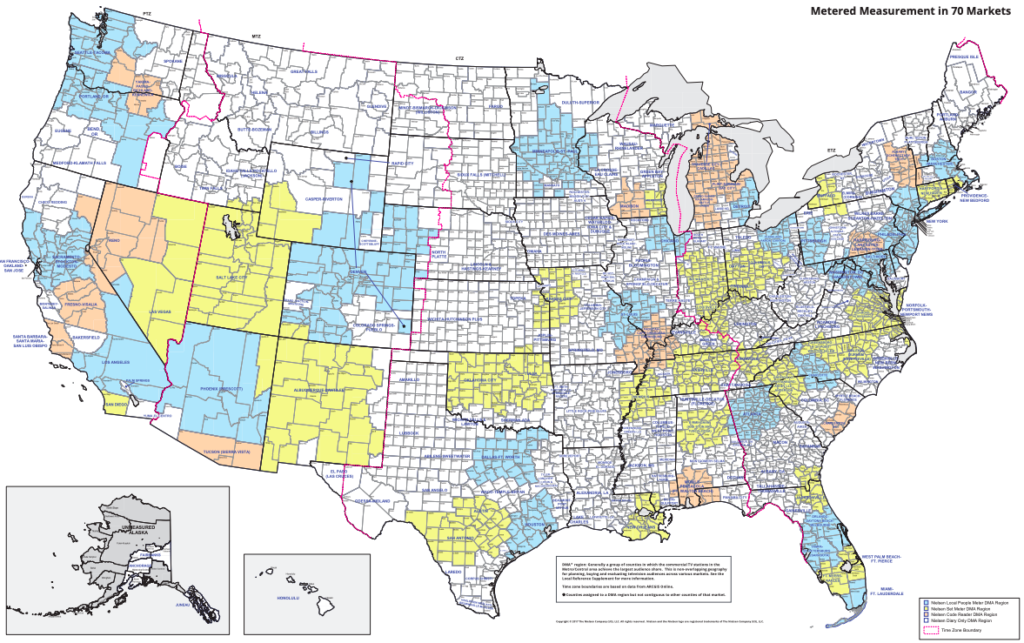

Order Custom Data🗺️ Custom Maps

The right market is going to jump off the map and grab you. Your team will stop checking Facebook and start talking about locations. Perfect for presentations.

Get a Custom MapNot sure what’s right? Contact us here — we’ll help you figure it out.