Recently, I did a little research for a custom data request about zip code income data for the entire US. I was looking for both historic & current income data. I found 2 different data sources that both provide current & historic US zip code income data: the US Census Bureau and the Statistics of Income program data on the IRS website.

The Least You Need to Know

The most current zip code income dataset that’s available right now for the entire US is the US Census Bureau’s 2011 ACS 5 year estimates. An updated ACS dataset will be released every year (i.e. by the end of 2013, the 2012 income data will be released.)

Data Source 1: US Census Bureau

| Year | Dataset |

| 2011 | ACS 5 year estimates |

| 2000 | Decennial Census 2000 SF3 Data |

| 1990? | Census FTP site |

| 1980? | Census FTP site |

First, the US Census Bureau provides income data for zip code tabulations areas (ZCTAs) — which are very similar to zip codes. I’ve got another blog post that explains the difference between ZCTAs and zip codes.

You can pull income data by ZCTA for all US ZCTAs for the years 2000 and 2011 on the Census Bureau’s website. For the 2000 income data, you’ll want to use the Decennial Census 2000 SF3 dataset. For the 2011 income data, you’ll want to use the ACS 5 year estimates dataset. Learn more about ACS data vs Decennial Census data. Each year, the Census Bureau will release updated ACS income data (i.e. in 2013, they will release the 2012 income data).

While there are zip code level data for the 1990 & 1980 decennial censuses AND there are income data for the 1990 & 1980 decennial censuses, I haven’t done the necessary digging to figure out if there are 1990 & 1980 zip code income data available. You can do this research by reading through the documentation on the Census’ FTP site (links are in the table above).

Your next question is probably “what income related data points can I get from the US Census Bureau”?

Popular Zip Code Income Data for 2011

I’m defining popular as my personal favorite tables as well as the tables that I pull most often for custom data requests. Most of the data below are in 2011 inflation-adjusted dollars.

General

- Mean Income in the Past 12 months

- Median Income in the Past 12 months

- Median Family Income in the Past 12 months

- Per Capita Income in the Past 12 months

Household

- Median Household Income in the Past 12 Months

- Median Household Income in the Past 12 Months for White Alone Householder; Black or African American Alone Householder; American Indian and Alaska Native Alone Householder; Asian Alone Householder; Native Hawaiian and Other Pacific Islander Alone Householder; Some Other Race Alone Householder; Two or More Races Householder; Hispanic or Latino Householder

Type of Income

- Wage or Salary Income in the Past 12 Months for Households

- Self-Employment Income in the Past 12 Months for Households

- Interest, Dividends, or Net Rental Income in the Past 12 Months for Households

- Social Security Income in the Past 12 Months for Households

- Supplemental Security Income (SSI) in the Past 12 Months for Households

- Public Assistance Income or Food Stamps/Snap in the Past 12 Months for Households

- Retirement Income in the Past 12 Months for Households

Poverty

- Poverty Status in the Past 12 Months

- Poverty Status in the Past 12 Months of Families by Family Type by Social Security Income by Supplemental Security Income (SSI) and Cash Public Assistance Income

Other

- Gini Index of Income Inequality

- Median Income in the Past 12 Months by Sex by Work Experience in the Past 12 Months for the Population 15 Years and over With Income

- Receipt of Supplemental Security Income (SSI), Cash Public Assistance Income, or Food Stamps/Snap in the Past 12 Months by Household Type for Children Under 18 Years in Households

Popular Zip Code Income Data for 2000

I was going to put together a list of tables for 2000 income data like the above list of tables for 2011 income data, but when I was working on the list for 2000 income data tables, there was a lot of overlap. Basically, you can get 2000 income data tables that are similar to the 2011 income data tables with a couple of exceptions. For example, there’s no Gini Index of Income Inequality table for 2000. The 2000 income data are in 1999 dollars.

Data Source 2 – SOI Tax Stats on the IRS website

| Year | Dataset |

| 2008 | Free |

| 2007 | $500 for US/$25 per state |

| 2006 | $500 for US/$25 per state |

| 2005 | $500 for US/$25 per state |

| 2004 | $500 for US/$25 per state |

| 2002 | $500 for US/$25 per state |

| 2001 | Free |

| 1998 | Free |

“SOI” stands for Statistics of Income. SOI is a program that publishes income data and is run by the Statistical Information Services, a US government agency.

The SOI is currently reviewing its methodology to safeguard individual taxpayer confidentiality. So the 2008 data set is a preliminary dataset that contains data for zip codes in which 250 or more returns were filed — which means that you won’t be able to get income data about rural zip codes from the preliminary data set. The data are based on individual income tax returns from the IRS’ Individual Master File system, which includes a record for every Form 1040, 1040, and 1040EZ. The records included in the 2008 dataset were returns that were filed between January 1, 2009 and December 31, 2009.

The 2008 dataset include the following data:

| Number of returns [1] | |

| Number of joint returns | Filing Status is Marriedfiling jointly |

| Number of returns with paid preparer’s signature | |

| Number of exemptions | 1040:6d |

| Number of dependents | 1040:6c |

| Adjust gross income (AGI) [2] | 1040:37 / 1040A:21 /1040EZ:4 |

| Salaries and wages | 1040:7 / 1040A:7 /1040EZ:1 |

| Taxable interest | 1040:8a / 1040A:8a /1040EZ:2 |

| Ordinary dividends | 1040:9a / 1040A:9a |

| Business or professional net income(less loss) | 1040:12 |

| Net capital gain (less loss) | 1040:13 1040A:10 |

| Taxable individual retirement arrangements distributions | 1040:15b / 1040:11b |

| Taxable pensions and annuities | 1040:16b / 1040A:12b |

| Unemployment compensation [3] | 1040:19 / 1040A:13 /1040EZ:3 |

| Taxable Social Security benefits | 1040:20b / 1040A:14b |

| Self-employment retirement plans | 1040:28 |

| Total itemized deductions [4] | Schedule A:29 |

| State and local income taxes | Schedule A:5a |

| State and local general sales tax | Schedule A:5b |

| Real estate taxes | Schedule A:6 |

| Taxes paid | Schedule A:9 |

| Mortgage interest paid | Schedule A:10 |

| Contributions | Schedule A:19 |

| Taxable income | 1040:43 / 1040A:27 /1040EZ:6 |

| Total tax credits [5] | 1040:56 / 1040A:34 |

| Residential energy tax credit | Form 5695:27 |

| Child tax credit | 1040:52 / 1040A:32 |

| Child and dependent care credit | 1040:47 / 1040A:29 |

| Earned income credit [6] | 1040:66a / 1040A:40a / 1040EZ:8a |

| Excess earned income credit(refundable) [7] | 1040:66a / 1040A:40a / 1040EZ:8a |

| Alternative minimum tax | 6251:35 |

| Income tax [8] | 1040:56 / 1040A:28 /1040EZ:10 |

| Total tax liability [9] | 1040:61 / 1040A:37 /1040EZ: 10 |

| Tax due at time of filing [10] | 1040:76 / 1040A:46 /1040EZ:12 |

| Overpayments refunded [11] | 1040:73 / 1040A:44a / 1040EZ:11a |

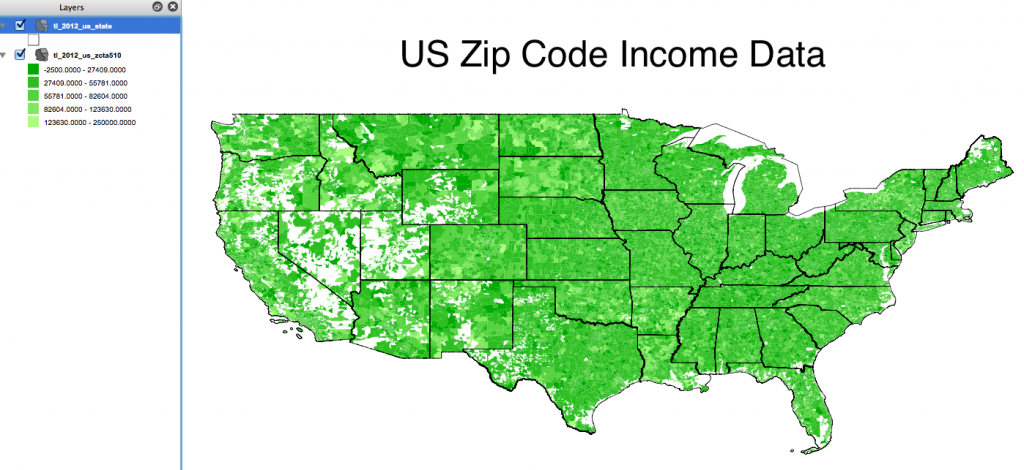

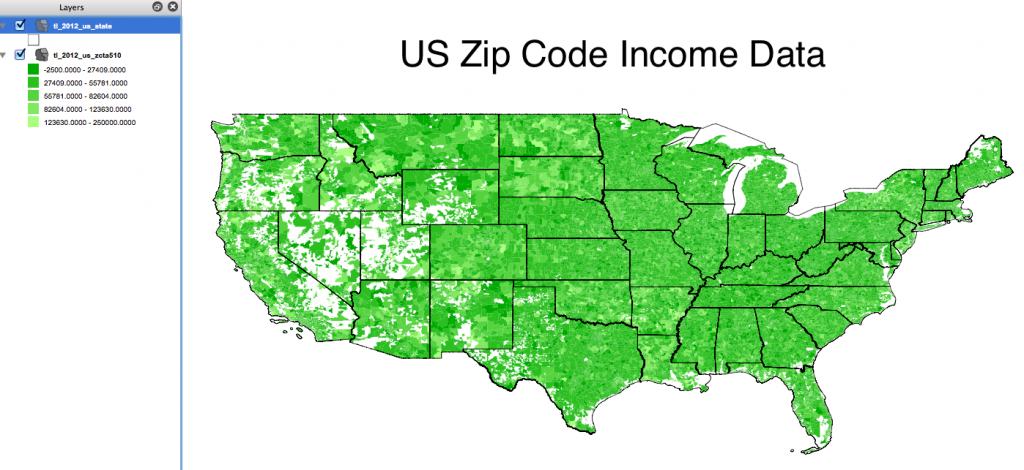

Zip Code Income Data Maps

Now that you know where to get income data for zip codes, you can use data to do some pretty cool analysis — like building zip code maps.

Here are some quick zip code income maps for the US and a couple of the largest states using the US Census Bureau’s 2011 data and my favorite free GIS – QGIS.

Comparing Historic Income Data

If you are interested in looking at changes in income over time, you’ll probably want to adjust for inflation.

Don’t Have Time to do Any of the Above Work but Still Need Zip Code Income Data?

I pull zip code income data for businesses for a fee. If you’d like to get a quote for me to pull this data for you, please complete the Custom Data Request form.